Some Ideas on Unicorn Financial Services You Should Know

Wiki Article

How Refinance Broker Melbourne can Save You Time, Stress, and Money.

Table of ContentsThe 5-Minute Rule for Mortgage Broker In MelbourneThe Greatest Guide To Mortgage Brokers MelbourneLoan Broker Melbourne Can Be Fun For AnyoneGetting The Melbourne Mortgage Brokers To WorkAn Unbiased View of Mortgage Brokers Melbourne

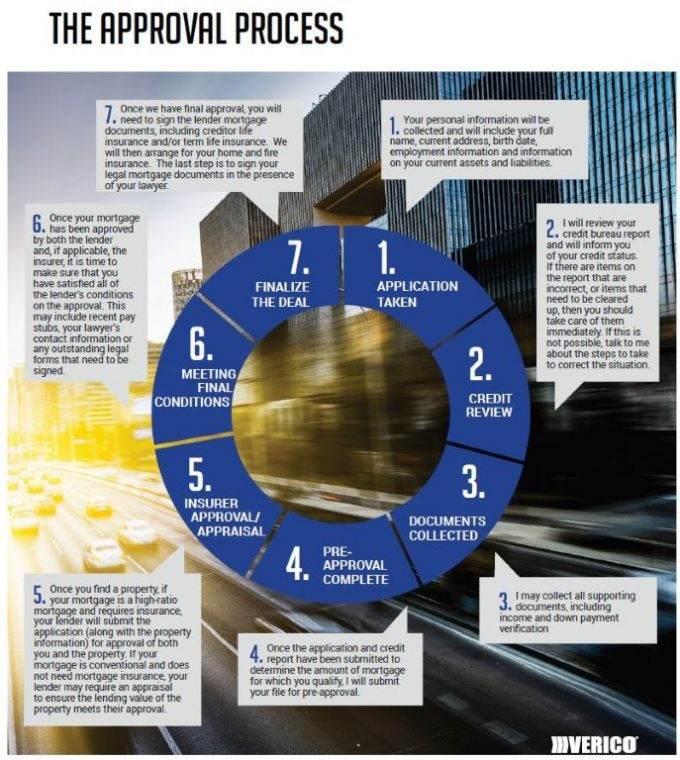

A specialist home mortgage broker originates, works out, and also processes residential and also industrial mortgage in support of the customer. Below is a 6 point overview to the solutions you need to be provided as well as the expectations you need to have of a certified mortgage broker: A mortgage broker provides a vast array of home loan from a variety of different lenders.A home loan broker represents your passions instead than the interests of a loan provider. They need to act not just as your representative, but as an educated professional as well as trouble solver. With access to a broad array of home loan items, a broker is able to supply you the best value in terms of rate of interest, payment quantities, as well as lending products (melbourne broker).

Lots of scenarios demand greater than the basic use of a three decades, 15 year, or adjustable rate home mortgage (ARM), so ingenious home loan methods as well as innovative services are the advantage of functioning with an experienced mortgage broker (https://americanbizlists.com/mortgage-broker/unicorn-financial-services-springvale-victoria/). A mortgage broker navigates the client through any scenario, handling the process and also smoothing any kind of bumps in the road along the road.

Debtors that discover they need larger lendings than their financial institution will accept likewise take advantage of a broker's understanding as well as capability to effectively obtain funding. With a home mortgage broker, you only need one application, instead than completing kinds for every individual loan provider. Your mortgage broker can supply a formal comparison of any car loans suggested, leading you to the details that accurately portrays cost differences, with existing rates, points, as well as closing costs for each car loan showed.

Unicorn Financial Services Fundamentals Explained

A credible home loan broker will reveal exactly how they are paid for their solutions, in addition to detail the total expenses for the financing. Personalized solution is the setting apart aspect when choosing a mortgage broker. You must expect your home loan broker to help smooth the method, be offered to you, as well as encourage you throughout the closing process.

Functioning with a home mortgage broker can potentially conserve you time, initiative, and also cash. A home mortgage broker might have much better and also more accessibility to lending institutions than you have. A broker's rate of interests may not be aligned with your own. You might obtain a far better offer on a finance by dealing directly with loan providers.

What Does Loan Broker Melbourne Do?

A home mortgage broker does as arbitrator for a banks that provides car loans that are protected with genuine estate and people that intend to acquire actual estate as well as need a car loan to do so. The home mortgage broker collaborates with both consumer as well as lending institution to get the consumer authorized for the lending.A mortgage broker normally functions with numerous various loan providers as well as can provide a selection of financing options to the borrower. A consumer doesn't have to work with a home mortgage broker.

While a home loan broker isn't required to help with the purchase, some lenders might just work via home mortgage brokers. If the loan provider you choose is amongst those, you'll need to make use of a home mortgage broker.

They're the individual that you'll deal with if you come close to a loan provider for a funding. The finance policeman can aid a customer recognize and also select from the fundings used by the lending institution. They'll answer all concerns, aid a customer get pre-qualified for a financing, as well as help with the application process.

Excitement About Refinance Broker Melbourne

Home mortgage brokers don't give the funds for car loans or approve financing applications. They help individuals seeking mortgage to locate a lending institution that can fund their home acquisition. Start by seeing to it you recognize what a home mortgage broker does. After that, ask buddies, loved ones, and organization colleagues for referrals. Take an appearance at on the internet reviews and also look for issues.Inquire why not look here about their experience, the precise aid that they'll give, the charges they bill, and just how they're paid (by loan provider or debtor). Also ask whether they can assist you particularly, given your details financial situations.

Confronted with the issue of whether or not to make use of a mortgage broker or a lender from a financial institution? Well, we are here to tell you, don't run to the bank! It's nothing personal. We enjoy banksfor things like saving and investing cash. When you are wanting to acquire a home, however, there are 4 crucial components that home mortgage brokers can use you that the loan providers at the bank just can not.

At Eagle Home mortgage Business, individual touch is something we satisfaction ourselves in. You get to work with one of our agents personally, that has years of experience as well as can address any questions you may have.

Getting My Refinance Broker Melbourne To Work

Their hours of procedure are normally while you're already at work. Get the individual touch you deserve with a home loan broker that cares! The adaptability a home mortgage broker can use you is simply an additional reason to stay clear of going to the bank.

Report this wiki page